What could the financial impact of a cyber loss event cost?

Published April 24, 2024 by Kyle Langan

Are smaller companies targeted with attacks?

Have you seen attempts at Funds Transfer Fraud, through phishing? Sinister sources send these attempts out frequently, and may be experienced the most by small businesses [1]. Weaker security measures are targeted, which is why lower sized operations could find themselves susceptible. [2] However, large entities, like Change Healthcare, are also targeted: “Large Scale Cyberattacks Disrupt Essential Substance Use and Mental Health Services.”

How should an operation mitigate its cyber risk?

How can we help? The team at Conrey Insurance Brokers and Risk Managers specializes in risk transfer. This transfer offers protection for the recovery from tangible or intangible losses related to a security breach or similar event arising from digital risks. [3] Cyber insurance allows companies to resume normal business operations faster, minimizing the cost of recovery. [4] Although we are not technology experts, we can also assist with the mitigation of cyber risk and tech errors and omissions, as we are paid by the insurer to help you.

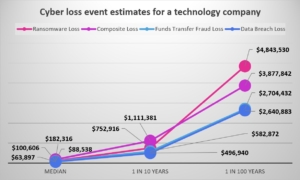

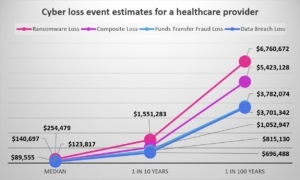

Ranked by expected severity

Cyber events could be categorized into the following sub-domains. [5] These all should follow a mitigation strategy:

Ransomware

Composite

Funds Transfer Fraud

Data Breach

Loss estimates (less than $25 MM Total Revenue):

“Data is from multiple sources, including Coalition’s own global data. Actual numbers may vary significantly from calculator estimates based on additional factors for a given business. The data provided is for informational and educational purposes only.”

References

[1, 2]

Rahmonbek, K. (2024, February 1). 35 alarming small business cybersecurity statistics for 2024. StrongDM. https://www.strongdm.com/blog/small-business-cyber-security-statistics

[3, 4, 5]

Cyber Insurance: Active Insurance & Cybersecurity. Coalition. (n.d.). https://www.coalitioninc.com/