Financial Services

Whether you started with a “germ of an idea” and grew it to something more substantial, or you took over something a family member passed into your capable hands for stewardship, you have a responsibility to consider the future and what it would look like with rosy growth or what the effect would be without contingency planning. Successful retirement is nothing that can be taken for granted. Retirement planning requires the development of strategy and proper execution of that plan with regular periodic evaluations.

There are many things to consider on a personal and a business level too. You need to plan for the future. Conrey Insurance Brokers and Risk Managers has a division of specialists who are well-versed in financial planning. These experts work with your attorney and CPA, or we can introduce you to an expert we know well, to assist with both individual and corporate planning, investment strategies, and retirement planning.

Specialized Expertise for Specific Needs

Highly respected industry professionals continue to bring their distinctive knowledge and skills to key functional areas of the growing Financial Services Department at Conrey Insurance Brokers and Risk Managers. Together, they’re building a team whose diverse capabilities help us meet all of your company and individual needs under one roof.

Financial Planning and Wealth Management – Mike Lambrakis, CFP® and Michael Hu, CFP®

A CERTIFIED FINANCIAL PLANNER™, Mike has served as a Partner Advisor with AdvicePeriod, as a Portfolio Strategist and Wealth Advisor at Beacon Pointe Advisors, and as a Financial Advisor at Wells Fargo Advisors.

Also a CERTIFIED FINANCIAL PLANNER™, Michael has held positions as an Advisor at AdvicePeriod, as well as at a private wealth management firm where he was responsible for developing, implementing and ongoing monitoring of complex financial plans.

Life Insurance, Annuities, Long-Term Care and Disability – Michael Robinson

Michael is a 24-year veteran of the insurance and financial services industry. Co-Founder and Managing Partner of BluePrint Insurance Services, he has extensive experience partnering with Registered Investment Advisors and comprehensive financial advisors across the country.

Individual Health and Medicare Services – David Mak

David been accumulating firsthand knowledge of the changing health insurance industry since he began helping clients with individual medical and Medicare insurance solutions in 2003. A self-described “numbers guy,” he spent his early years in financial reporting for corporations such as Douglas, Boeing, and Scantron.

Creation and Administration of Business Retirement Plans – Michael Gorelick, APR

Michael is an Accredited Pension Representative, and a frequent presenter at retirement plan workshops and webinars. His decades of experience include the role of President at Benefit Equity, Inc., a retirement plan administration and benefits consulting firm serving small-to-midsize businesses.

Group Health Benefits – Kelly Moore, CEBS and Cathy Solomon

Kelly is a Certified Employee Benefits Specialist with over 20 years of experience managing plans for diverse organizations, including serving as Principal and Senior Client Executive at benefits firm OneDigital. She previously managed plans for small- to Fortune 500-sized firms at Marsh, one of the world’s largest employee benefits firms.

Cathy has served as a group health insurance broker and employee benefits strategist for companies in a wide variety of industries, acting in her role as a Client Executive at OneDigital. She specializes in analyzing, evaluating and managing a variety of plans for small- and mid-market companies ranging from 20 to 250 employees.

To speak with one of our professionals, please give us a call or request a meeting online. We’re ready to help.

For Your Family

Very simply stated, the discipline of financial services, in its crux, is the core concept of making sure people retire successfully, that they live long without outliving their money. When it comes to personal finances, our focus centers on retirement planning. Recognizing the uncertainty of Social Security, retirement planning is more critical than ever – especially when people are living longer than ever.

Whether you are single or married, no matter where you are in life’s journey, young or old, active or retired, planning and review are a key component to successful retirement. Through vehicles such as wealth management planning, life insurance, disability, long-term care insurance, annuities, financial planning, coordinating of trusts and asset protection, the strategists at Conrey Insurance Brokers and Risk Managers will help you develop an investment and or insurance portfolio that will protect your assets and ensure your future.

For Your Business

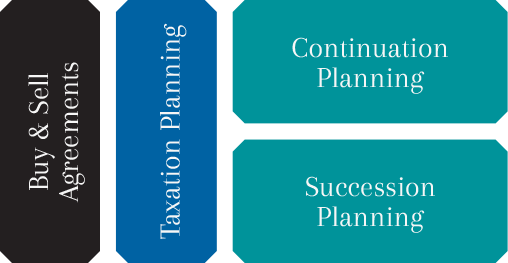

Risk management for business must verify that management has considered exposures – both traditional and those less obvious. Business continuation planning is an area management often fails to consider fully. We assist both ownership and management in the development of strategies to minimize the impact operations face when calamity strikes – especially when it affects key members of ownership or management.

Contingency planning is a part of any proper and solid business plan. A strategic Business Continuation Plan can make all the difference in the future of any business – big or small, including contingencies, disabilities and succession plans.

The experts in our Financial Services division can assist you with business continuation planning and review, business valuation and defining the methodology for future valuations. We can even assist with Buy-Sell Agreements, making sure that all parties are considered objectively, and that the needs of the key persons involved are adequately addressed.

We welcome the opportunity to show you best practices in the discipline of insurance and financial services.