Published January 14th, 2022 by Kyle Langan

Recent Wildfires

Recent wildfires in Colorado and California highlight concerning macro issues regarding climate change. According to NASA, 90 percent of biomass burning is human instigated; this contradicts a common perception that most wildfires are caused by acts of nature, such as lightning. [1] According to Dr. Joel Levine, a biomass burning expert at NASA, humans are at fault for macro-level harsher weather events. [2] The devastating Colorado wildfire from December 30, 2021, may cause $1 billion in insured losses. [3] The late-season wildfire destroyed nearly 1,000 buildings and homes as it swept through Boulder County, CO. The fire was fueled by months of unusually warm, dry weather and intense winds. [4] It ranks as the most destructive wildfire in the Colorado history — it burned 6,000 acres and nearly doubled the amount of damage and insured losses caused by Colorado’s October 2020 fire. [5] In Colorado, the wildfire season does not typically extend into the winter, as snow cover and cold temperatures prevent fire spread. Fire is part of a general trend of a lengthening fire season and drier fuels in the Western US due to climate change. [6]

This video below displays historic temperature changes visually with NASA data driven heat maps.

Video: Global Warming from 1880 to 2021 (NASA)

Inadequate Coverage?

In Colorado, insurers have opened a mobile insurance village to assist affected residents. [7]

Unfortunately, rebuilding costs for many policyholders may exceed their insurance limits. Labor shortages, supply chain disruption, and inflation have pushed construction costs to the upside. [8] For example, a property owner, whose home was destroyed in Colorado’s October 2020 wildfire, told the Wall Street Journal his policy limits of $900,000 and $700,000 for the dwellings fell short of the approximately $2 million in rebuilding and required upgrade costs. [9] Homeowners should check with their risk manager to confirm their homes’ replacement cost valuation is accurate and that coverage is adequate. In order to effectively manage the exposure they face, property owners must ensure protection is as adequate as believed. To verify this, and to seek a broad range of expert risk advisory, consult with Conrey.

California: PG&E Gets Blamed

In California, the even larger ‘Dixie Fire’ stripped forests and forced thousands from their homes after it began on July 13, 2021. [10] It burned a total of nearly 1 million acres through Northern California and destroyed 1,329 structures. [11] Sadly, it also caused one fatality. The Pacific Gas and Electric (PG&E) utility company has been blamed for the fire, after a tree fell on PG&E owned electrical distribution lines. [12] The blaze was the second-largest in California’s history; 963,000 acres is an area larger than New York City, Chicago, Dallas and Los Angeles combined. [13]

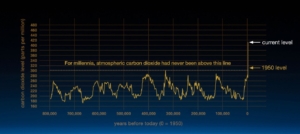

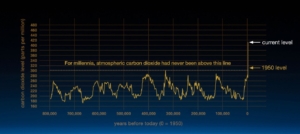

Current Levels of Atmospheric Carbon Dioxide (NASA):

Fire Harm Reduction

Cal Fire urged Californians to “remain vigilant and be prepared for wildfire,” after climate change continues to “turbocharge severe storms, floods and extreme weather across the United States.” [14]

PG&E said they will continue to be tenacious in their efforts to stop fire ignitions from its equipment and to ensure safety [15] In July of 2022, “the company plans to bury 10,000 miles of California power lines in an attempt to prevent its equipment from sparking wildfires, a project that would probably cost tens of billions of dollars and take well over a decade to complete”. [16]

Indoor Fire Mitigation – Tragedies Strike in PA, NY

In contrast, the Philadelphia area has recently faced two devastating tragedies related to indoor fires. On Christmas morning, a house fire occurred in Bucks County, Pennsylvania. It claimed the lives of a father and his two children. Quakertown Police Chief Scott McElree said early indications were that the fire started in the family’s Christmas tree. [17] The fire took the lives of Eric King, 40, his sons, Liam, 11, and Patrick, 8, and their two dogs. Eric’s wife Kristin and their oldest son Brady managed to escape before the fire destroyed their entire home. [18] The blaze was deadly because the fire started within the walls of property after the family’s Christmas tree ignited and burned the home and its contents. The pine tree, wrapped with lights and electrical wires contributed to the increased fuel load inside the home. Fuel load is the expected amount of combustible material in a given area (what is inside a property that can burn). The house’s increased fuel load was the cause of this heart-wrenching tragedy.

To make matters worse for the Philadelphia community, on January 5, in Fairmount, a 5-year-old child accidentally ignited a Christmas tree while playing with a lighter. Three women – Rosalee McDonald, Virginia Thomas and Quinsha White – and nine of their children died in the fire, according to family members. [19] The blaze was the deadliest fire in Philadelphia in more than a century. [20] None of the six smoke alarms found in the unit were functional, and only one was still installed. This tragedy had been the deadliest fire in years at a U.S. residential building, but was surpassed on Jan. 9 by a fire in a high-rise in New York City’s Bronx borough that killed 17 people, including several children. [21] Support the King Family here; Fairmount families here; and New York here.

Risk management applies to any and all situations. It is a vital aspect of life. To prevent situations like this from happening, it is recommended to decorate a fake tree when Christmas rolls around next year. Reducing fuel load is the best way to minimize fire risk and prevent ignition. Further, frequently ensure that smoke detectors are fully functional. Verifying the functionality of smoke detectors can reduce loss of life from fires. During any time of year, take steps to acknowledge what contributes to your home’s fuel load, and have a construction professional inspect walls to certify they are as fire resistive as they can be; this will limit the spread of fire if a blaze does start.

Works Cited

1-2: Dunbar (NASA).

3-9: Ayers, 2022.

10-16: Washington Post, 2022.

17-18: Solis, 2021.

19-21: Staff 6abc, 2022.

References

Ayers, E. (2022, January 10). Colorado wildfire insured losses to reach $1b, Modeler says. Risk Manager FPN. Retrieved January 15, 2022, from https://www.advisen.com/tools/fpnproc/fpns/articles_new_24/P/418750667.html?rid=418750667&list_id=24

Dunbar, B. (n.d.). Wildfires: A symptom of Climate Change. NASA. Retrieved January 15, 2022, from https://www.nasa.gov/topics/earth/features/wildfires.html

NASA. (2022, January 12). Climate change evidence: How do we know? NASA. Retrieved January 15, 2022, from https://climate.nasa.gov/evidence/

NASA. (2022, January 13). Video: Global warming from 1880 to 2021 – climate change: Vital signs of the planet. NASA. Retrieved January 15, 2022, from https://climate.nasa.gov/climate_resources/139/video-global-warming-from-1880-to-2021/

Solis, G. (2021, December 27). Christmas Day house fire kills father, 2 children in Quakertown, PA.. 6abc Philadelphia. Retrieved January 15, 2022, from https://6abc.com/quakertown-house-fire-father-and-sons-killed-eric-king-christmas-pennsylvania-tragedy/11390602/

Staff, 6abc D. (2022, January 12). ‘near certainty’ Fairmount Fire ignited when Christmas tree set ablaze, Philadelphia officials say. 6abc Philadelphia. Retrieved January 15, 2022, from https://6abc.com/fairmount-fire-atf-philadelphia-firefighters-north-23rd-street-investigation-philly-blaze/11454578/

Washington Post. (2022, January 5). PG&E equipment blamed for Dixie Fire that burned nearly 1 million acres in California . Risk manager FPN. Retrieved January 15, 2022, from https://www.advisen.com/tools/fpnproc/fpns/articles_new_24/P/418388483.html?rid=418388483&list_id=24