What is Your Strategy for this Overlooked Liability Protection?

Published October 1st, 2021 by Kyle Langan

Negligent actions or inactions of a company’s officers or board of directors resulted in record high settlements in 2020. Private companies are at risk – not just publicly traded firms.

Example: A wrongful act results in the individuals who serve as directors and officers being sued for the breach of their corporate duties at a mid-sized company.

Privately held companies facing losses like these report an average loss of $387,000, and a maximum loss of $17 million. [1] How would your company fund a loss like this?

The only policy that would cover the exposure in the example above is directors and officers liability.

Does your current risk management strategy only account for property, auto, and general liability losses? General Liability policies do not pay for financial losses of a company, but management liability insurance can. Management liability policies include three main types: directors and officers, employment practices liability, and fiduciary liability.

There is an often-misunderstood coverage that will defend and finance this type of exposure: directors and officers. It is an available safety net that your company’s risk manager may have overlooked, or never considered.

What is D&O?

Directors and Officers (D&O) is a type of management liability insurance covering directors and officers for claims made against them while serving on a board of directors and/or as an officer of a company [2]. Policies cover managerial decisions that result in adverse consequences for both large and small companies alike [3]. This line of management liability protection is not solely applicable to publicly traded companies. Additionally, it should not be viewed as an expense, but as an asset to any company. An effective risk manager will break down the cost structure of this protection and implement a plan to prevent economic losses of this nature. Lastly, entity coverage covers claims made directly against the organization, and it can be added as an extension to a D&O policy.

Status of the D&O Market Price?

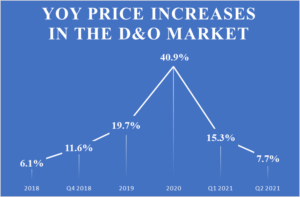

In a ‘hard market,’ insurance carriers exhibit a decrease in risk appetite. During a hard market, insureds must be presented as an attractive risk because underwriters have strict conditions for coverage. Insurers are focused on underwriting performance and the portfolio management of the businesses competing for cover. The D&O market has achieved hard-market pricing increases since Q4 of 2018 [4]. However, increases are slowing; insurers are experiencing new capacity for D&O risk in 2021. [5]

Prices continued to rise as of July 1, 2021, but at a lesser rate than in recent renewals; some experts believe rates may be flat by this time next year. [6] 2021 has seen significantly lower rate hikes than in 2020.

What’s Driving D&O Rates?

Mergers and Acquisitions (M&A) played a role in the hardening D&O insurance market. Insurers responded to this with higher retention levels and expensive rates [7]. Companies should eliminate and avoid the following D&O hazards that have been the subject of recent M&A litigation:

- Misconduct and investigations regarding the actions of directors and officers [8]

- Failing to disclose internal or external investigations related to a company’s actions or the broad actions of its officers and directors [9]. This causes investor retaliation, which is a D&O exposure for private and public entities.

- Anything that can be determined as false or misleading information [10]

- Omissions and statements like the ones causing recent SPAC lawsuits [11]

- Overstating of financial prospects. Misrepresentation has always been an exposure to D&O Risk (either willfully or inadvertently) [12]

YOY price trend analysis:

Businesses have been competing for coverage in a difficult D&O market since 2019 (See graph below). It is clear that the hard market started in Q4 of 2018 with an 11.6% increase, leading into 2019, which saw a sharp price increase of nearly 20% on average in the D&O market. In 2020, it tightened up even further up to 41%. This is when some companies were potentially forced to self-fund for this management liability risk because purchasing D&O insurance was no longer economical. However, in 2021, the slower pace of increase proves there is new capacity from insurers within the D&O market. The 15% Q1 price increase average between public companies (21%) and private companies (10%) this year shows that if the current trend continues, the worst of the hard market is behind us.

Because of the clear trend, the worst of the hard market may be over. Experts like John M. Orr, D&O liability product leader for Willis Towers Watson, agree with this statement. [13] However, it is still important to protect your business before a loss arises. Looking ahead, there is likely to be more flat renewals, potentially more frequent rate decreases, and increased competition among insurers. [14]

*Companies experienced an average settlement of $54.5 Million per claim in 2020 for D&O liability losses; Appendix [15]

With price increases trending downwards towards flat renewals, it is an excellent time to evaluate your current D&O risk management strategy. At Conrey, my team and I attack the root cause of what drives D&O rates with a proprietary system of data analytics and enterprise risk management proven to reduce total cost of risk. Contact me at kylel@conreyins.com to see how I can do this for your business.

—

[1] Privately-held companies and Directors & Officer’s Insurance: Why not? Summit. (2021, September 3). Retrieved October 5, 2021, from https://www.yoursummit.com/knowledge-center/privately-held-companies-and-directors-officers-insurance-why-not/

[2-3] IRMI – Directors and officers liability insurance. Directors and Officers (D&O) Liability Insurance | Insurance Glossary Definition | IRMI.com. (n.d.). Retrieved September 28, 2021, from https://www.irmi.com/term/insurance-definitions/directors-and-officers-liability-insurance.

[4] Greenwald, J. (2019, March 14). D&O pricing rises in fourth quarter of 2018: AON. Business Insurance. Retrieved from https://www.businessinsurance.com/article/00010101/NEWS06/912327297/D&O-pricing-rises-in-fourth-quarter-of-2018-Aon.

[5] AM best to join D&O-focused panel at the RE/Insurance Lounge. Business Wire. (2021, September 21). Retrieved September 24, 2021, from https://www.businesswire.com/news/home/20210921005776/en/AM-Best-to-Join-DO-Focused-Panel-at-the-ReInsurance-Lounge.

[6] Greenwald, J. (2021, August 2). D&O prices up 7.7% in second quarter: AON. Business Insurance. Retrieved September 29, 2021, from https://www.businessinsurance.com/article/20210802/NEWS06/912343627/D&O-prices-up-77-in-second-quarter-Aon.

[7] Moorcraft, B. (2021, September 16). How M&A has impacted the hard D&O Insurance Market. Insurance Business America. Retrieved September 24, 2021, from https://www.insurancebusinessmag.com/us/news/professional-liability/how-manda-has-impacted-the-hard-dando-insurance-market-310286.aspx.

[8] Barton, R. E. (2021, September 2). Caution ahead: Spac litigation trends provide a road map for directors and officers. Reuters. Retrieved September 24, 2021, from https://www.reuters.com/legal/legalindustry/caution-ahead-spac-litigation-trends-provide-road-map-directors-officers-2021-09-02/.

[9-11] Barton, R. E., 2021.

[12] Moorcraft, B., 2021.

[13-14] Greenwald, J. (2021, July 6). D&O rate hikes moderate as new capacity arrives. Printed from BusinessInsurance.com. Retrieved September 24, 2021, from https://www.businessinsurance.com/article/20210706/NEWS06/912342985?template=printart.

[15] Greenwald, 2019; Ross, 2021; Gallagher, 2021; Greenwald, 2021

Ross, H, Woleben J. (2021, May 5). D&O premiums rise 41% YOY in 2020; loss ratios hold steady. Accelerating Progress. Retrieved September 27, 2021, from https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/d-o-premiums-rise-41-yoy-in-2020-loss-ratios-hold-steady-63997938.

Gallagher – 2021 Spring/Summer Market Report. (n.d.). Retrieved September 27, 2021, from https://www.ajg.com/us/-/media/files/gallagher/us/news-and-insights/insurance-market-update-spring-summer-2021.pdf.