Lessons from Deepwater Horizon Oil Spill: Embedding a Culture of Risk Management

Published June 20th, 2023 by Kyle Langan

Running a business involves speculative risk. A successful strategy brings an expectation of positive returns, while carrying a small but significant risk of catastrophic losses.

On April 20, 2010, “the inherent risks of decades of inadequate regulation, insufficient investment, and incomplete planning were realized in tragic fashion.” [1] This shows how errors develop into catastrophic loss. “The Deepwater Horizon rig sank on April 22, two days after the well blowout and explosion that tragically killed 11 workers in the Macondo Prospect.” [2] Roughly 4.9 million barrels spilled into the Gulf of Mexico, “based on flow-rate estimate, which ranged from 62,200 barrels per day on April 22 to 52,700 barrels per day on July 14, just before the capping stack stopped the flow.” [3]

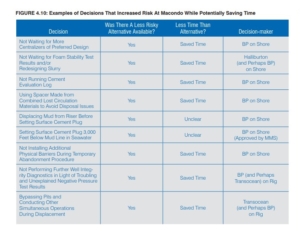

The loss stemmed from roots of leadership’s culture of urgency and frugality. “Decision-making processes “did not adequately ensure that personnel fully considered the risks created by time- and money-saving decisions.” [4]

Source: (National Commission on the BP Deepwater Horizon Oil Spill and Offshore Drilling, 2011).

Source: (National Commission on the BP Deepwater Horizon Oil Spill and Offshore Drilling, 2011).

As seen in the chart above, an overriding sense of urgency to bring new wells on line without delay or marginal cost contributed to a risk-taking culture among the Macondo well-site workers and their managers. More time-consuming but safer alternatives were presently available in all the root causes of loss. Instead, “snap decision-making without supporting evidence, abandonment of procedural safeguards, ignoring of obvious safety-check warnings, and other dangerous behaviors took precedent.” [5]

Solution: A Culture of Risk Management

The findings of the Commission “highlight the importance of organizational culture and a consistent commitment to safety by industry, from the highest management levels on down.” Improved regulatory oversight aims to solve a culture of revenue maximization and complacency. The GPO recommends a “pervasive top-down safety culture.” [6] “The critical element is an unwavering commitment to safety at the top of an organization: the CEO and board of directors must create the culture and establish the conditions under which everyone in a company shares responsibility for maintaining a relentless focus on preventing accidents.” [7] For example, a company “rewards employees and contractors who take action when there is a safety concern even though such action costs the company time and money.” [8]

If a company “rigorously adheres to the best practices of a functioning safety culture”, it can prevent catastrophic losses. [9]

References

[1]-[5];[7-9]

National Commission on the BP Deepwater Horizon Oil Spill and Offshore Drilling. “Deep Water: The Gulf Oil Disaster and the Future of Offshore Drilling.” U.S. Government Publishing Office’s (GPO). (2011, January). https://www.govinfo.gov/content/pkg/GPO-OILCOMMISSION/pdf/GPO-OILCOMMISSION.pdf

The Institutes Knowledge Group. The Institutes. (n.d.). https://web.theinstitutes.org/